Planned Giving - Charitable Remainder Trust

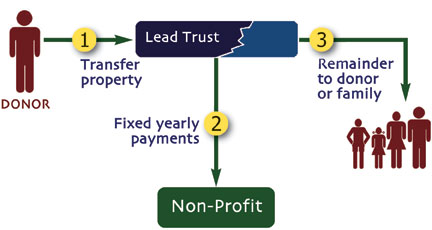

Entering into a Charitable Remainder Trust with the Foundation means that you leave a capital donation (securities, real estate and/or cash) to the Foundation while you are enjoying your retirement years. The trustee (financial institution) pays you and/or other beneficiaries you name in the trust for life, or a fixed number of years. When the trust terminates, the trustee pays out the remaining assets to the Moose Jaw Health Foundation. Please consult your professional advisor before establishing a trust with the Moose Jaw Health Foundation.

the Foundation while you are enjoying your retirement years. The trustee (financial institution) pays you and/or other beneficiaries you name in the trust for life, or a fixed number of years. When the trust terminates, the trustee pays out the remaining assets to the Moose Jaw Health Foundation. Please consult your professional advisor before establishing a trust with the Moose Jaw Health Foundation.

When the trust is established, you'll receive a donation receipt equal to the present value of the trust's assets. You also receive an annual income from the trust and the Foundation receives the remaining value of the trust after you pass on.

Example

Bob Schmidt, 68, establishes a charitable remainder trust by transferring stocks with a cost base of $450,000 and a fair market value of $500,000. He names himself as sole income beneficiary and the Moose Jaw Health Foundation as beneficiary of the remainder of the trust. The stocks have been furnishing Bob with annual dividend income of $10,000. Two months after the transfer, the trustee sells the stock and purchases bonds paying 7%.

|

1. Amount contributed to trust

|

$500,000

|

|

2. Charitable Donation receipt to Bob

|

|

|

( based on 7% discount rate*)

|

$197,885

|

|

3. Capital gain recognized as a result of transferring stock to trust

|

$50,000

|

|

4. Amount of taxable gain

|

|

|

(#3 x 50%)

|

$9,894

|

|

5. Tax on gain

|

|

|

( assuming a 46.4% tax rate)

|

$4,591

|

|

6. Tax credit (assuming a 44.2% combined credit)

|

|

|

(#2 x 44.4%)

|

$87,465

|

|

7. Net tax savings

|

|

|

(#6 - #5)

|

$82,874

|

|

8. Capital gain taxed to trust when property is sold

|

$0

|

|

Income before gift

|

$10,000

|

|

Income after gift

|

$35,000

|

With this gift, Bob increases his cash flow, reduces his taxes, and makes a significant future gift to help patients at Moose Jaw’s Hospital. Please see your investment professional to determine if a charitable remainder trust is right for you.

Each and every gift to the Moose Jaw Health Foundation is deeply appreciated and will help save and enhance the lives of patients.

For more information, please contact the Moose Jaw Health Foundation office at 694-0373 or by email at kelly.mcelree@mjhfoundation.ca. Thank you for considering the Moose Jaw Health Foundation in your estate planning. Every gift, no matter what the size, makes a difference.