Planned Giving - Annuities

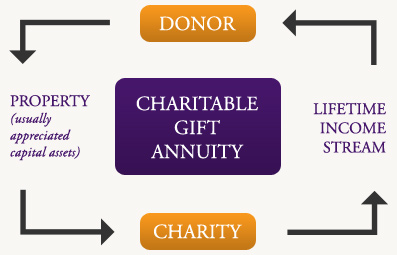

This type of planned gift allows you to make a lump sum gift and receive periodic income in return. It's a real benefit for people age 65 and  older, where the after-tax cash flow from a Charitable Gift Annuity is often greater than from a fixed income investment such as a GIC. It provides guaranteed rates of return for the rest of your life, while allowing you to make a significant gift to enhance patient care at the Dr. F.H. Wigmore Regional Hospital. A charitable gift annuity is an irrevocable gift of capital so, it's best to consult a financial or legal advisor first before choosing this type of gift to the Moose Jaw Health Foundation.

older, where the after-tax cash flow from a Charitable Gift Annuity is often greater than from a fixed income investment such as a GIC. It provides guaranteed rates of return for the rest of your life, while allowing you to make a significant gift to enhance patient care at the Dr. F.H. Wigmore Regional Hospital. A charitable gift annuity is an irrevocable gift of capital so, it's best to consult a financial or legal advisor first before choosing this type of gift to the Moose Jaw Health Foundation.

The amount of the annual payments will depend on the amount transferred, the ages of the beneficiary (or annuity term), and the annuity rate schedule in effect at the time of the gift. Your investment advisor or financial institution will be able to provide you with the latest information and help to assist you with this. Once the annuity is established, the payments will remain fixed, regardless of changes in the economy. This makes the gift annuity especially attractive to older donors who like the security of fixed, guaranteed payments. The annuity agreement will also specify how often payments are to be made and when they are to begin. Those who wish may have the payments made directly to their bank account.

Example

Bill Jones, 80, donates $50,000 to the Moose Jaw Health Foundation to establish a charitable gift annuity. Based on Canada Customs and Revenue Agency prescribed tables, his life expectancy is 10.6 years, his annuity interest rate is 8.4%

|

1. Amount contributed

|

$50,000

|

|

2. Annual income to Mr. Jones

|

|

|

(8.4% of capital contributed)

|

$4,200

|

|

3. Total expected income

|

|

|

(#2 x Bill's life expectancy)

|

$44,520

|

|

4. Amount of donation receipt to Bill

|

|

|

(#1 - #3)

|

$5,480

|

|

Taxation of Income:

|

|

|

Total expected income

|

$38,220

|

|

(#2 x 9.1 - different table required by Revenue Canada *)

|

|

|

Each payment is considered to consist entirely of capital return no matter how long Bill lives.

|

|

|

Amount of tax on income payments

|

|

|

Annual tax free income

|

$4,200

|

Bill will receive an annual tax-free income of $4,200 for life and a tax receipt of $5,480 while making an immediate gift to enhance patient care at the Dr. F.H. Wigmore Regional Hospital.

Please see your investment professional to determine if an annuity is right for you. For more information, please contact the Moose Jaw Health Foundation office at 694-0373 or by email at kelly.mcelree@mjhfoundation.ca. Thank you for considering the Moose Jaw Health Foundation in your estate planning. Every gift, no matter what the size, makes a difference.